Business Needs

Accurate and efficient claim handling is crucial for insurance companies to maintain customer satisfaction and operational excellence. As a result, they are striving to ensure consistent and standardized claim handling practices across adjusters which is also essential for maintaining quality and compliance. The insurance companies are looking for intuitive and effective training methods which can significantly enhance the efficiency, accuracy, and professionalism of their claims handling processes.

Few of the important questions asked by Insurance companies:

- How to speed up insurance claim adjuster's readiness without having to learn on the job?

- How to create real-life claims scenarios that is difficult to recreate in training environment?

- How to reduce training cost for insurance claim adjusters?

- How to make the training more engrossing and an enjoyable experience for new hires?

- How to make it easy to review and learn from mistakes?

01Discover

We conducted our research to understand the business challenges faced by insurance companies which arises from several key factors:

Enhanced learning experience

Cost and time efficiency

Risk mitigation

Claim handling efficiency

Standardization

Technology adaptation

Persona

Upon observing the day in the life of an auto claim adjuster, we found that they were using several tools and paper forms to assess and record the claims. We identified two personas who were the potential users of the application.

02Define

We needed to find an intuitive, cost-effective and interactive learning experience that will transform the existing training methods. We chose Virtual Reality (VR) technology which provides a highly immersive learning experience that closely mirrors the actual work environment.

Some of the key advantages of VR technology:

- Trainees can be placed in realistic simulations where they can actively engage with the content, develop critical thinking skills, and better retain knowledge.

- It offers a cost-effective alternative by reducing the need for physical setups and enabling scalable, remote training options.

- Virtual simulations allow trainees to experiment, make decisions, and understand the consequences of their actions, leading to more confident and competent adjusters.

- It allows trainees to practice and learn at their own pace, potentially accelerating the onboarding process.

- It offers a controlled and standardized learning experience, where all trainees are exposed to the same scenarios, information, and evaluation criteria which establishes consistent workflows, adherence to best practices, and uniformity in claim assessment and resolution.

03Design

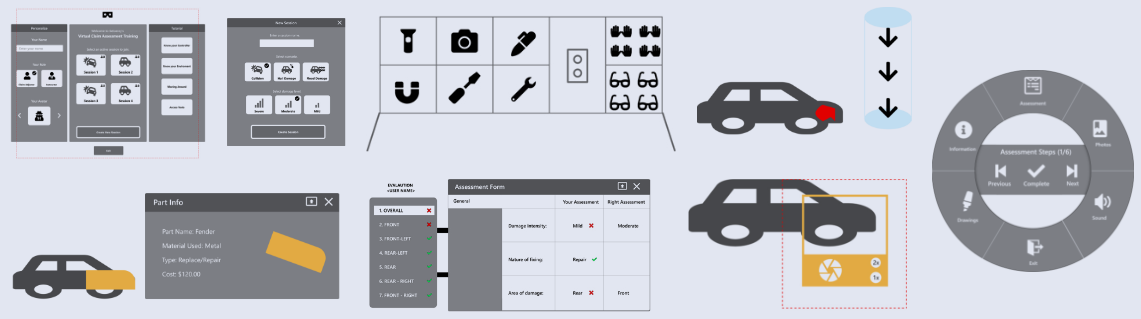

We designed the whole virtual experience to closely simulate the real garage scene, which included the garage, car and various tools. We enabled the animations of the car parts which mimicked the physical interactions such as opening and closing of the doors. We virtualized the way the tools including the paper forms used in a typical claim adjudication process so that the user gets to experience and learn the end-to-end process.

The experience was designed around the two personas (learner and instructor) where the instructor will be able to join the experience to observe and guide the learner who is undergoing the virtual training. The application also guides the learner in a step-by-step manner to complete the process.

We introduced an AI-based bot within the virtual experience which assumed the role of the driver/owner of the car and answered the questions asked by the learner in real-time regarding the details of the accident such as time and location of the accident, speed of the car during the collision, etc. This feature simulates the physical scenario where the claim adjuster interacts with the driver/owner of the car to get more details of the damage which will assist in the claim adjudication process.

04Solution

Our VR-based Auto Insurance Claim Adjuster Training Solution is designed to transform traditional training methods and provide a highly immersive and effective learning experience for insurance professionals. By leveraging the power of virtual reality (VR), we offer a comprehensive training platform that enhances knowledge retention, improves decision-making skills, and increases overall efficiency in the claims adjustment process. The solution can be extended by adding further scenarios to continuously expose auto insurance claim adjusters to lot more scenarios sooner to make them confident.

Key Features

- Realistic simulation: Car model and other physical tool interactions

- Real-time feedback and evaluation: Immediate evaluation of training session

- Multi-user collaboration: Claim adjusters and Instructors

- Multiple sessions: Create & join sessions anytime

- Custom avatars: Personalization with custom avatars

- Configurability: Ability to configure multiple claims scenarios

- Intelligent bot: Get answers in real-time by asking AI bot

- Intuitiveness: Onboarding experience for beginners

Potential Benefits

- Accelerates adjuster's readiness before moving on to the real job

- Reduces cost such as traveling and hiring specialized claims trainers

- Risk-free learning with a safe and controlled environment for trainees

- Scalability and cost-efficiency by training a large number of adjusters anywhere, anytime

- Expose to lot more scenarios sooner to make adjusters confident

- Enhanced engagement creating a memorable and enjoyable experience for new hires

By adopting our VR-based Auto Insurance Claim Adjuster Training Solution, insurance companies can significantly enhance the efficiency, accuracy, and professionalism of their claims handling processes. Equip your adjusters with the immersive training they need to excel in their roles and deliver exceptional customer experiences.